Data to Look at Before Grading

It's obviously important to carefully inspect your card before grading, but there are also some key data points to consider that can help you get the most out of your grading orders.

As I’ve been doing a bit more grading, I’ve gotten a bit smarter with how I approach things. It’s not just about evaluating the condition of the card, though obviously that’s very important, but about using data to help guide whether or not a card warrants grading in the first place.

It’s worth calling out that if you’re grading purely for PC purposes, most of the advice below doesn’t really apply. But if you’re grading with the hope to sell and earn a little bit of profit, a few minutes with data goes a long way towards making sure you’re grading the right cards.

Break-even grade

The first thing I figure out is what grade I need to break-even. Grading isn’t super cheap, and there’s always a shot that I won’t get the grade I was hoping for, so I need to know what the lowest possible grade is that I can get where I can still sell the card for at least the money I’ve got into it (grading fees plus purchase price).

For this, I use Market Movers.1

Let’s use Amon-Ra St. Brown’s 2021 Optic Blue Scope #228 as an example, because he’s fantastic and the card is pretty gorgeous.

The first thing I do is look up the raw value of a card to see what it’s going for right now. For any card I’m considering purchasing, this helps me figure out a reasonable expectation for cost. For any card in my collection already, it helps me identify how much I could potentially be getting for that card if I sold it raw.

Looking at this, I can see that the last sales was $12.50, and the 30-day average is $9.58, so anything between $10-$13 is a reasonable purchase price.

Next up, I need to see at what point I would break-even if I bought one of these and tried to grade it.

Market Movers has a really handy “duplicate this card” button you can click to instantly add the card in other grades. If I add the PSA 9 and PSA 10, I can get a sense for what those are going for in graded condition.

A PSA 9 is getting around $30 and a PSA 10 should get around $75 (obviously there’s some wiggle room up and down for both, but this is a good guideline).

Grading at a Value Bulk level is going to cost about $20 with a membership and after shipping, so if I can buy the card at $12, and grade it at $20, I’d have $32 into the card. That’s pretty close to the PSA 9 price point (when you factor in selling fees we’d lose a little), so we can call the PSA 9 our break-even point.

Grading Rates

Now that we have our break-even point, the next thing I like to look at is what percentage of that card has received that break-even grade or higher. There’s a lot of focus on gem rate, and that’s important to as it helps us figure in upside, but I would argue the break-even grade level is more important as it lets us see how much wiggle room we have in the grade. Gem rate may give you upside, but your break-even grade helps you assess the risk.

For this, I use GemRate’s Universal Search.

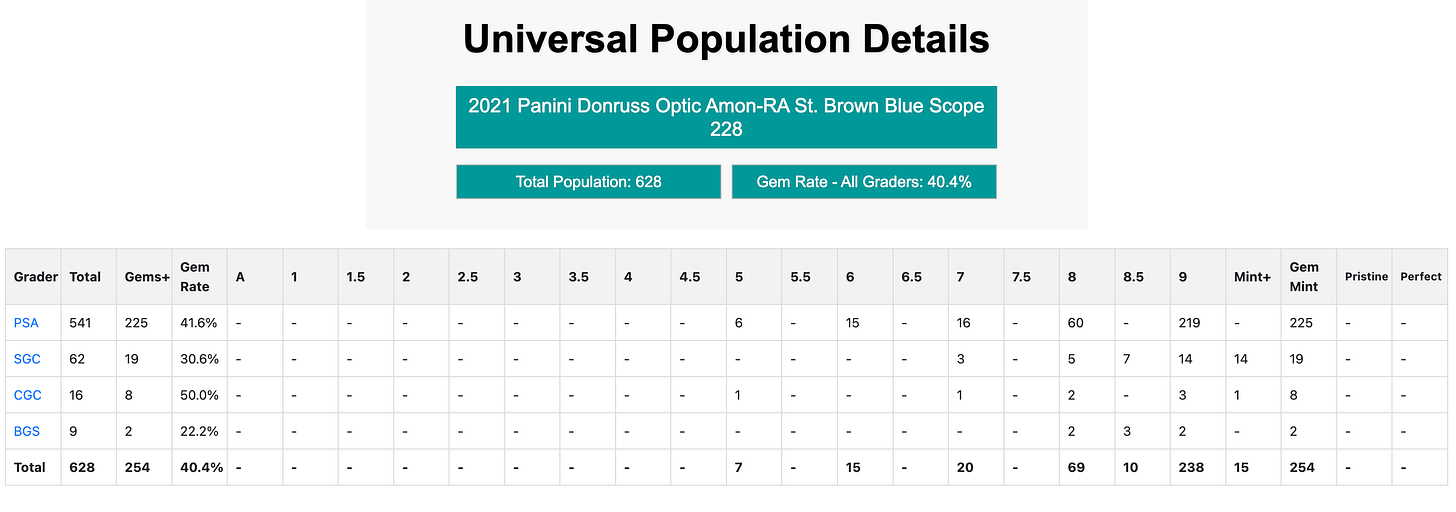

If I pull up data for this card, I can see how it has graded across PSA, SGC, BGS and CGC.

Based on the data here, we can see that, at PSA, this card gem’s 41.6% of the time. That’s not great, though probably about middle of the road for modern releases (it should be higher, but man, some of the sets that get released have truly awful quality control…don’t get me started on the nightmare that is finding grade-able Prizm cards).

However, we know that while our aim is a 10, a 9 still let’s us break-even. It looks like 219 of the 541 cards graded by PSA got a 9, bringing the rate of 9’s to 40.5%. So if we do the math, we end up at 82.1% of this card that have been graded hit our break-even point our higher.

That’s a much nicer number, and it tells us that as long as we can keep our initial purchase price down, this is a reasonable card for us to to look for in good raw condition to attempt to grade. Even if we sent in 5 and we only hit that 41% gem rate, we would still come out ahead because we don’t lose much at a 9 and our odds are very high that we’re going to get one of those two grades (again, assuming it’s a decent quality card).

Volume as a caveat

There’s one less data point that we can’t overlook: volume, both in sales and grades.

The more often a card has sold, the more predictable the sales value is going to be. If we aren’t seeing it sell a lot, there’s a strong likelihood that we may have to be very patient to make the sale, or that we may have to expect higher variability in the sales price.

This card is actually a great example of sales volume cautioning us a bit.

Going back to Market Movers, we can see that there’s actually only been one PSA 10 sale in the past 30 days. In fact, there has only been 4 PSA 10 sales in the past 90 days, and the latest was the highest.

Seeing this, we might want to have a bit more caution before diving in full-steam ahead on trying to buy a bunch of this card to grade and sell. It doesn’t mean there’s not still potential upside in this card, but it does mean we should probably move with a bit more caution as our sales price may not be as predictable as we would hope.

Another thing you need to be cautious of is newer releases. Newer releases that haven’t had time to be graded a ton make our grading results a bit less reliable, and newer releases also tend to sell at much higher prices right after release and right after the first graded versions start to hit. So if you are looking at potentially picking up a few cards to grade and you see those first few PSA 10’s selling at a really high value, you may want to expect that the actual price you could sell at when your graded cards come back could be quite a bit lower. Those Victor Wembanyama Hoops PSA 10’s were getting $175-$200 when the first graded versions started to hit eBay, and now you can get them for less than $75.

Safer Grading with Data

Grading takes time and money, and most of us don’t have tons of money to just throw around at a bunch of stuff—if we’re grading a card we want to sell later, we want to make sure that we’re coming out ahead.

A little data diving can go a long way towards helping us understand a card’s risk and ceiling, and let us make more informed decisions about which cards to try to grade in the first place.